Original | Odaily Planet Daily (@OdailyChina)

Author | Asher (@Asher_ 0210)

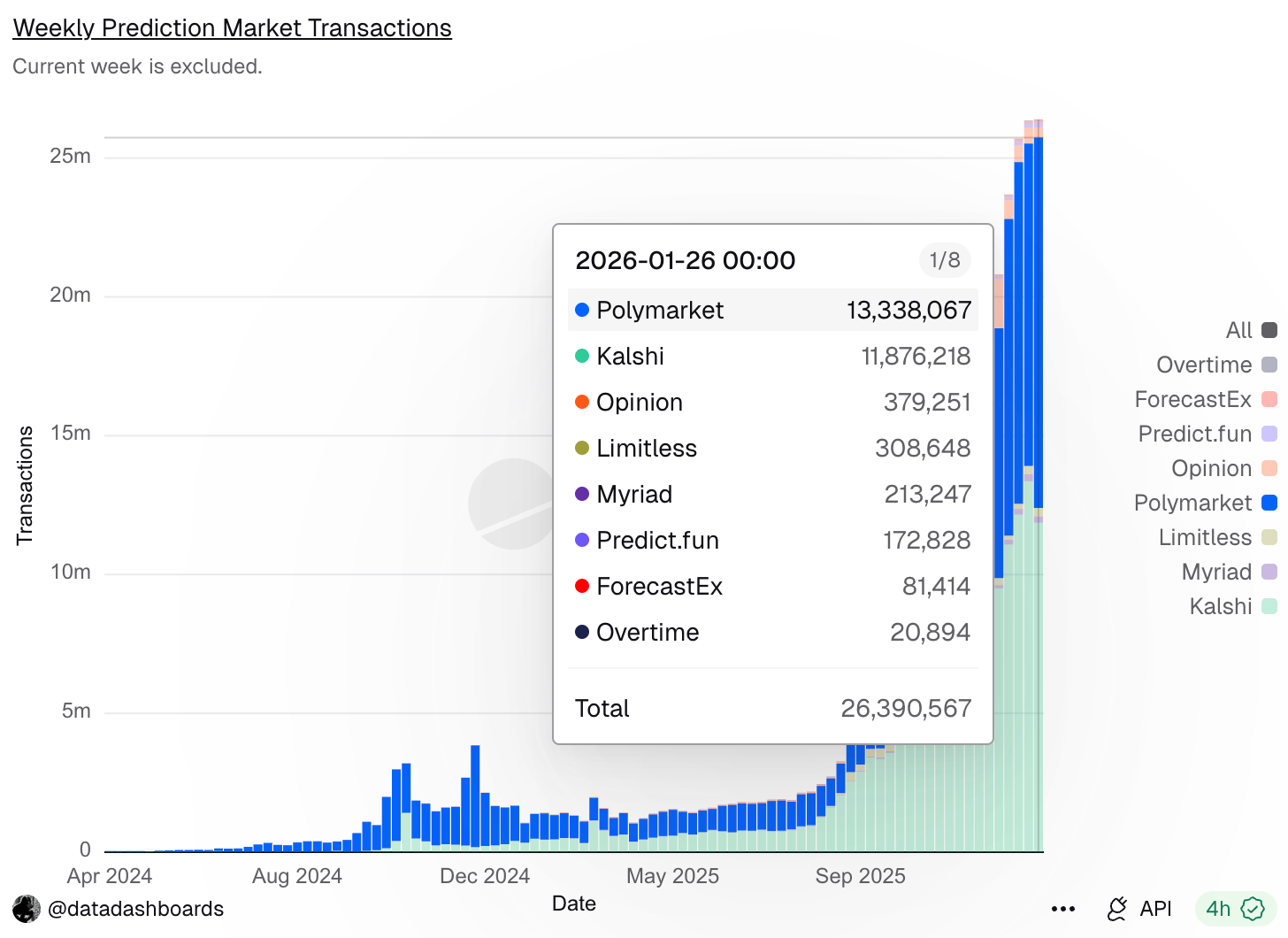

Although the market plummeted last weekend, the weekly number of transactions in the prediction market hit a record high. According to Dune data, the number of prediction market transactions last week reached 26.39 million, with Polymarket recording 13.34 million transactions, ranking first; Kalshi had 11.88 million transactions, ranking second; Opinion had 379.3 thousand transactions, ranking third.

Prediction market transaction count data for last week

Below, Odaily Planet Daily summarizes the recent developments of leading projects in the prediction market.

Two Giants: Polymarket and Kalshi

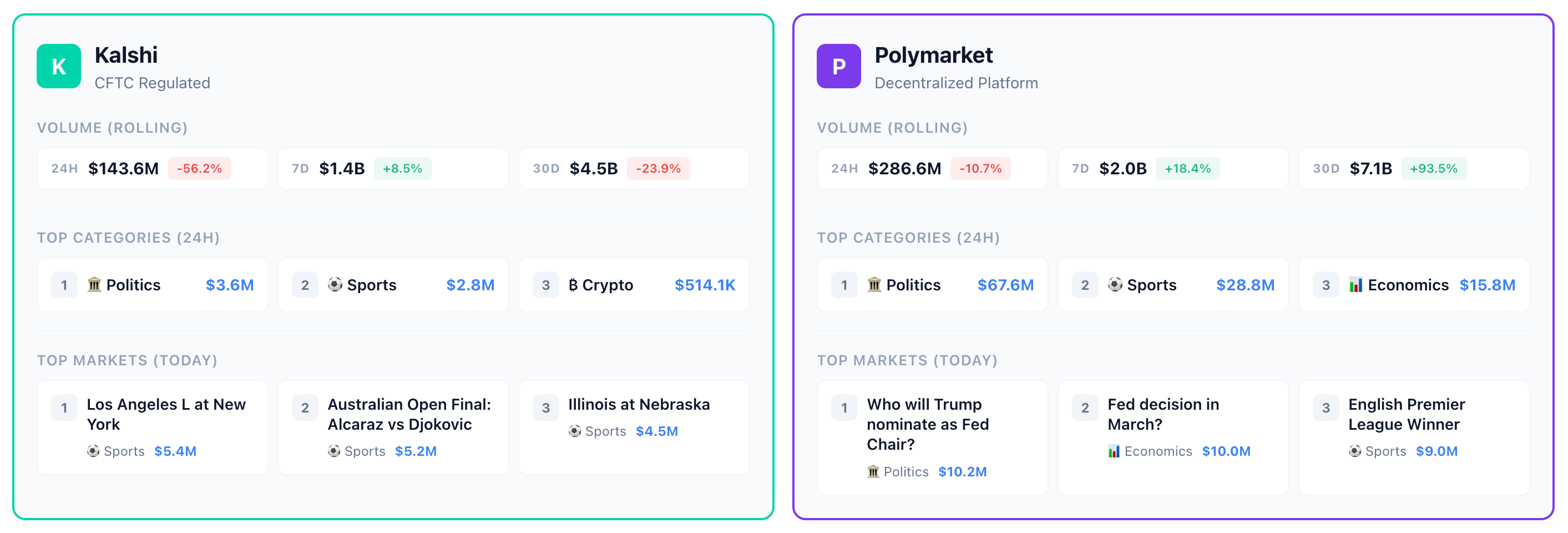

According to DeFi Rate data, in addition to the record high weekly transaction count in the prediction market, the recent trading volumes of the two giants, Polymarket and Kalshi, have also remained high.

Among them, Polymarket's trading volume last week reached $2 billion, a month-on-month increase of 18.4%, ranking first among similar platforms; Kalshi's weekly trading volume was $1.4 billion, with a weekly increase of 8.5%, ranking second.

Looking at a longer period, the trading data over the past 30 days shows a clear divergence: Polymarket's trading volume has generally maintained an upward trend, possibly related to the warming market expectations for its potential token issuance; in contrast, Kalshi's trading volume has continued to decline over the past 30 days, showing a more obvious downward trend.

In addition to trading volume data, the recent noteworthy developments of the two giants include:

Polymarket

1. Polymarket has started charging up to 3% trading fees in 15-minute crypto up/down markets. According to data, Polymarket's official documentation has added a "Trading Fees" page, clearly stating that fees will be enabled in 15-minute crypto up/down markets. This adjustment indicates that Polymarket has begun charging up to 3% taker fees in these short-term markets.

2. Polymarket launches a real estate prediction market, allowing users to bet on housing price trends. On-chain real estate platform Parcl and Polymarket announced a partnership aimed at introducing Parcl's daily housing price index into Polymarket's new real estate prediction market. Users can predict the rise and fall of specific city housing price indices on a monthly, quarterly, or annual basis, as well as threshold outcomes. Each market will reference a dedicated Parcl resolution page to display the final settlement value, historical index context, and calculation methods.

3. Polymarket designated as the prediction market partner for the Golden Globe Awards and launched a Polymarket Golden Globe Awards prediction market board at the event. Polymarket posted on platform X, stating that Polymarket has been designated as the exclusive prediction market partner for the Golden Globe Awards. Additionally, the Golden Globes official account posted: "Golden Globes awards season meets Polymarket's prediction season," accompanied by a picture of the Polymarket Golden Globe Awards prediction market board.

4. Jupiter announces integration with prediction market Polymarket. Jupiter posted on platform X announcing the integration with prediction market Polymarket. This integration will make Jupiter an innovative prediction platform on Solana, allowing users to directly use Polymarket through the "Predict" feature built into the Jupiter App.

5. Polymarket signs exclusive licensing partnership with Major League Soccer (MLS). Polymarket announced a multi-year exclusive licensing agreement with Major League Soccer (MLS), making it the sole prediction market partner of MLS. According to the agreement, the cooperation covers the MLS Cup, various conference events, and the All-Star Game. The two parties will also launch new fan experiences, including "second-screen interaction" during games, to enhance viewing engagement.

Kalshi

Kalshi platform transactions require prior US KYC identity verification, making it difficult for the vast majority of users to participate. Notable developments are mostly at the macro level.

1. Kalshi to host the first Prediction Market Conference in March. Kalshi CEO and co-founder Tarek Mansour posted on platform X, stating plans to host the first Prediction Market Conference in March. Researchers, economists, policymakers, and traders will gather to discuss core issues surrounding prediction markets and knowledge aggregation.

2. Coinbase Prediction Markets fully launched in all 50 US states through Kalshi. Coinbase recently announced that its Prediction Markets, through its partnership with Kalshi, are now officially available to users in all 50 US states, marking the product's transition from a limited testing phase to nationwide full deployment. This service allows users to trade on the outcomes of real-world events such as politics, sports, entertainment, culture, and macroeconomic indicators.

Coinbase stated that prediction market contracts are currently all provided by Kalshi, which is a compliant prediction market platform regulated by the US Commodity Futures Trading Commission (CFTC). More platform contracts may be integrated in the coming months. Prediction market contract prices reflect the market's collective probability judgment on event outcomes. Users can manage related trades in the same Coinbase interface alongside crypto assets, stocks, and cash positions, with a minimum trade amount of $1 (USD or USDC).

Opinion: Affected by the crash, TGE may be delayed

Opinion is the first prediction market platform on the BNB Chain ecosystem. According to ROOTDATA data, Opinion announced the completion of a $5 million seed round financing on March 18 this year. This round was led by YZi Labs, with participation from echo, Animoca Ventures, Manifold, Amber Group, and others. Additionally, Opinion was one of the top 4 performing projects in the previous Binance Labs MVB program.

According to official information, on January 26, Opinion's official website added an airdrop binding interface, supporting the allocation binding of up to 5 wallets. This move may indicate that Opinion will issue a token airdrop.

Opinion official website added airdrop binding interface

Moreover, Opinion founder Forrest stated in an interaction on the official Discord at the end of last year that "TGE is not expected to be later than February 17 (Chinese New Year)".

Opinion founder's response regarding TGE

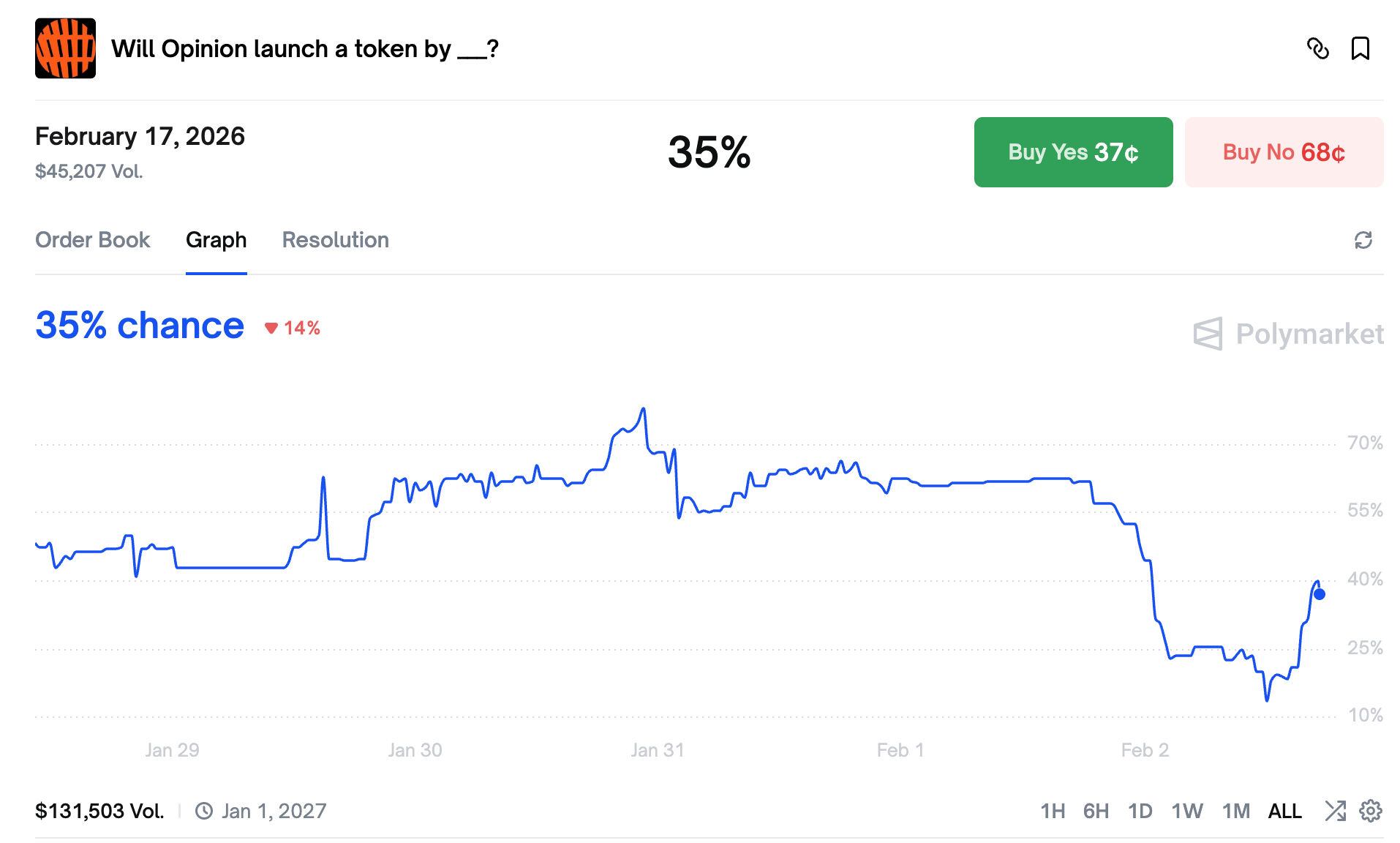

However, due to last week's market crash, community members generally believe that Opinion will delay the TGE time. According to Polymarket data, the probability of the event "Will Opinion officially launch its governance token before February 17?" has continued to fall from over 70% at the end of January, dropping to a low of below 15%, and has now rebounded slightly to currently report 35%.

Probability of the event "Will Opinion officially launch its governance token before February 17?" significantly reduced

predict.fun: Points activity enters week 7, platform liquidity improves after launching Boost points activity

predict.fun is a prediction market platform also launched on BNB Chain. Its founder is dingaling, a well-known figure in the NFT field. Unlike traditional prediction markets like Polymarket and Kalshi, predict.fun has achieved a key innovation: funds used by users for prediction are no longer idle but can simultaneously generate additional returns during the prediction period.

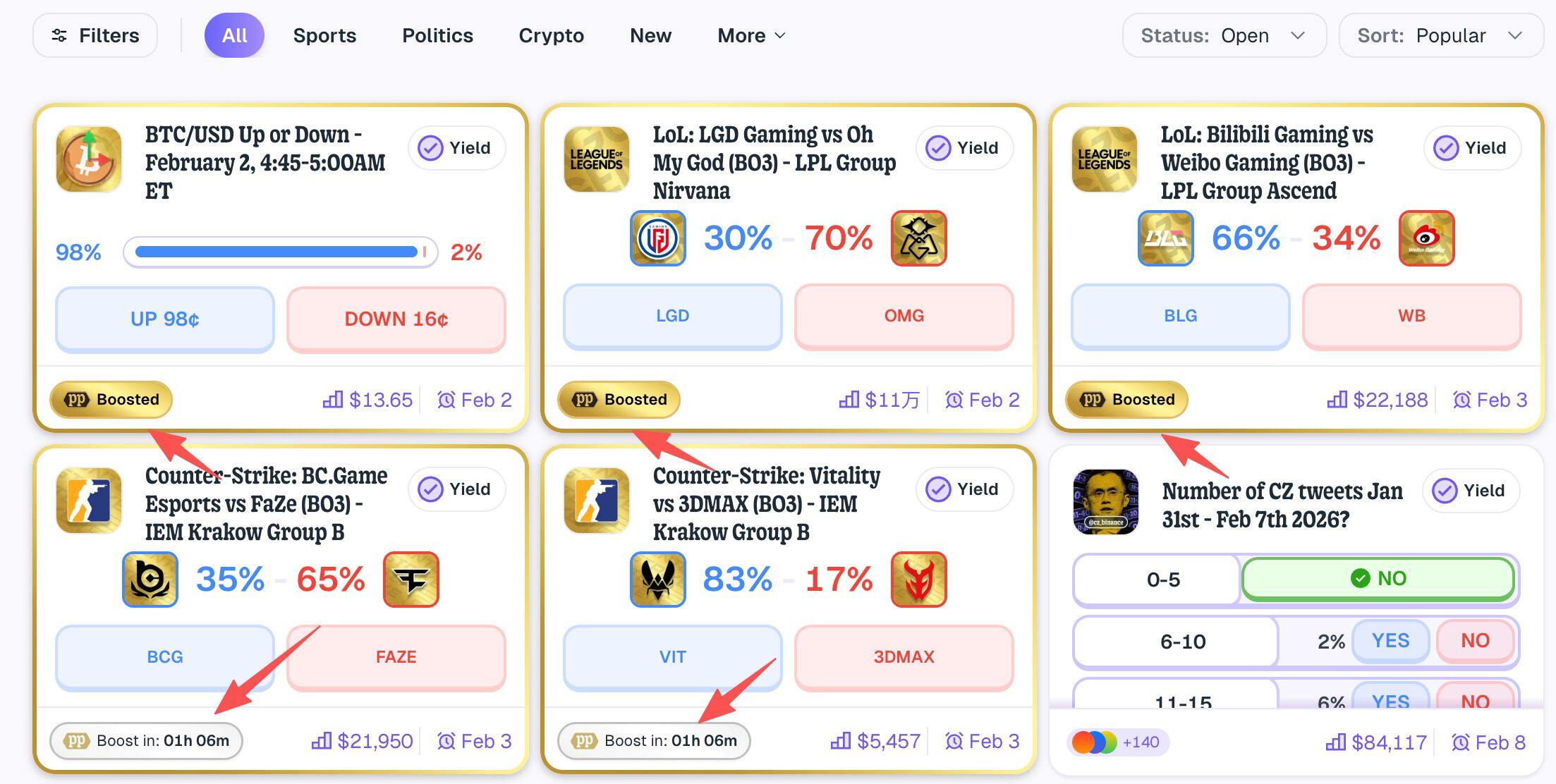

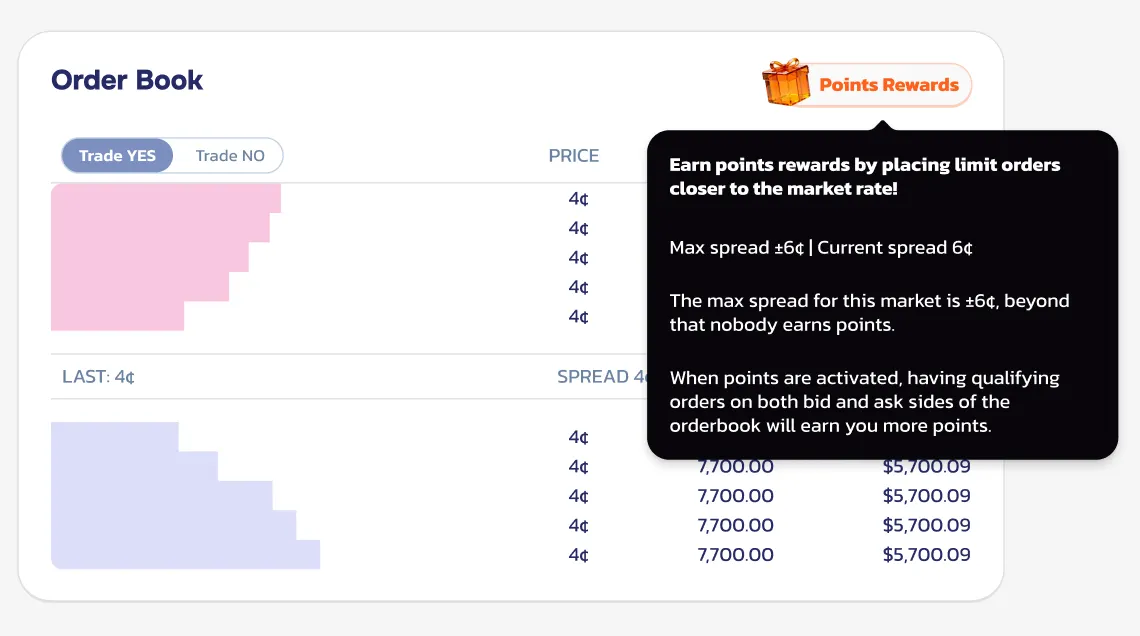

On January 20, predict.fun announced the launch of the Boost points multiplier activity. Events marked with the golden Boosted badge will receive more points (the specific multiplier has not been disclosed), mostly sports events.

predict.fun launches Boost activity

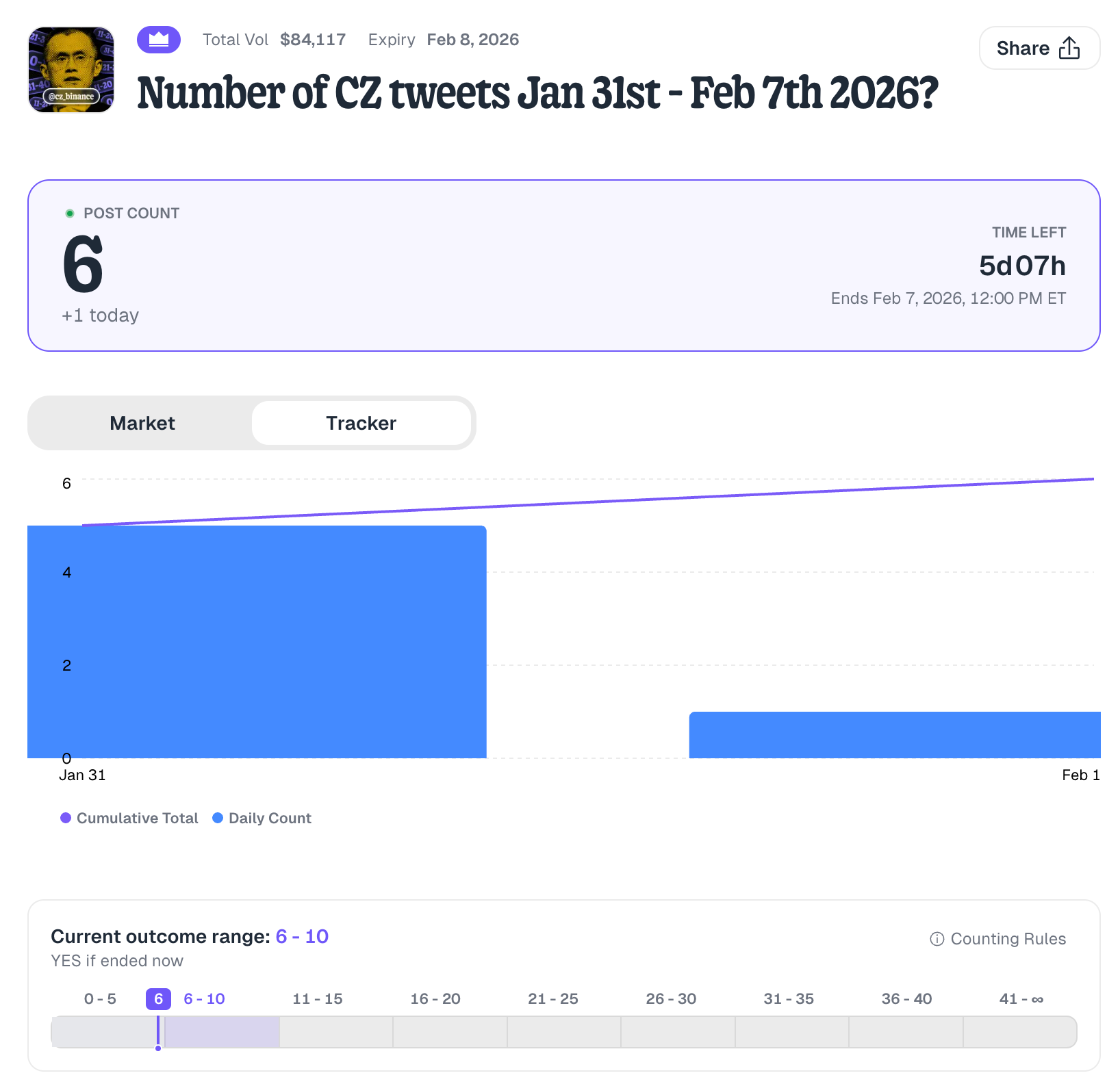

Additionally, to enrich the types of events listed, predict.fun launched the "Number of tweets posted by CZ" event, increasing community discussion about the platform.

predict.fun launches the "Number of tweets posted by CZ" event

Probable: Liquidity points rewards launched from February 2nd

Probable is a fully on-chain prediction market platform incubated by PancakeSwap (platform language supports switching to Simplified Chinese). This project is supported by PancakeSwap and YZi Labs and will be exclusively deployed on BNB Chain.

Community users mock that platform points are given to users who wash trade. Currently, the platform still offers 0 fee trading (including market orders), allowing for lossless point farming. There may be users engaging in "self-trading" or wash trading. Except for the first event which had extremely high trading volume (the first event was previously whether the Fed would cut rates in February, now changed to whether Satoshi Nakamoto will move Bitcoin this year), other events have low trading volume and extremely poor liquidity.

Probable homepage display

It is worth noting that today (February 2), Probable officially announced that liquidity points rewards will be launched starting this week. Perhaps after the liquidity points rewards are launched, the platform's points will be distributed more to real trading users. Odaily Planet Daily will continue to report on community feedback regarding point distribution.

Probable launches liquidity points rewards